No offer to buy nor sell any instrument is being made on this site. By accessing this site and its products/services you agree to all terms of our Disclaimer. Consult with a registered investment advisor prior to making trading and/or investment decisions. We are a publisher of educational content. We are not an investment advisor, financial planner nor registered broker. Trading is a high-risk, speculative activity. No profitability nor performance claims of any kind are being made. Disclaimer: All information provided herein is published for educational purposes only and should not be construed as investment advice. We make no profitability nor performance claims of any kind all information is published for educational use only. Past performance is not necessarily indicative of future results.

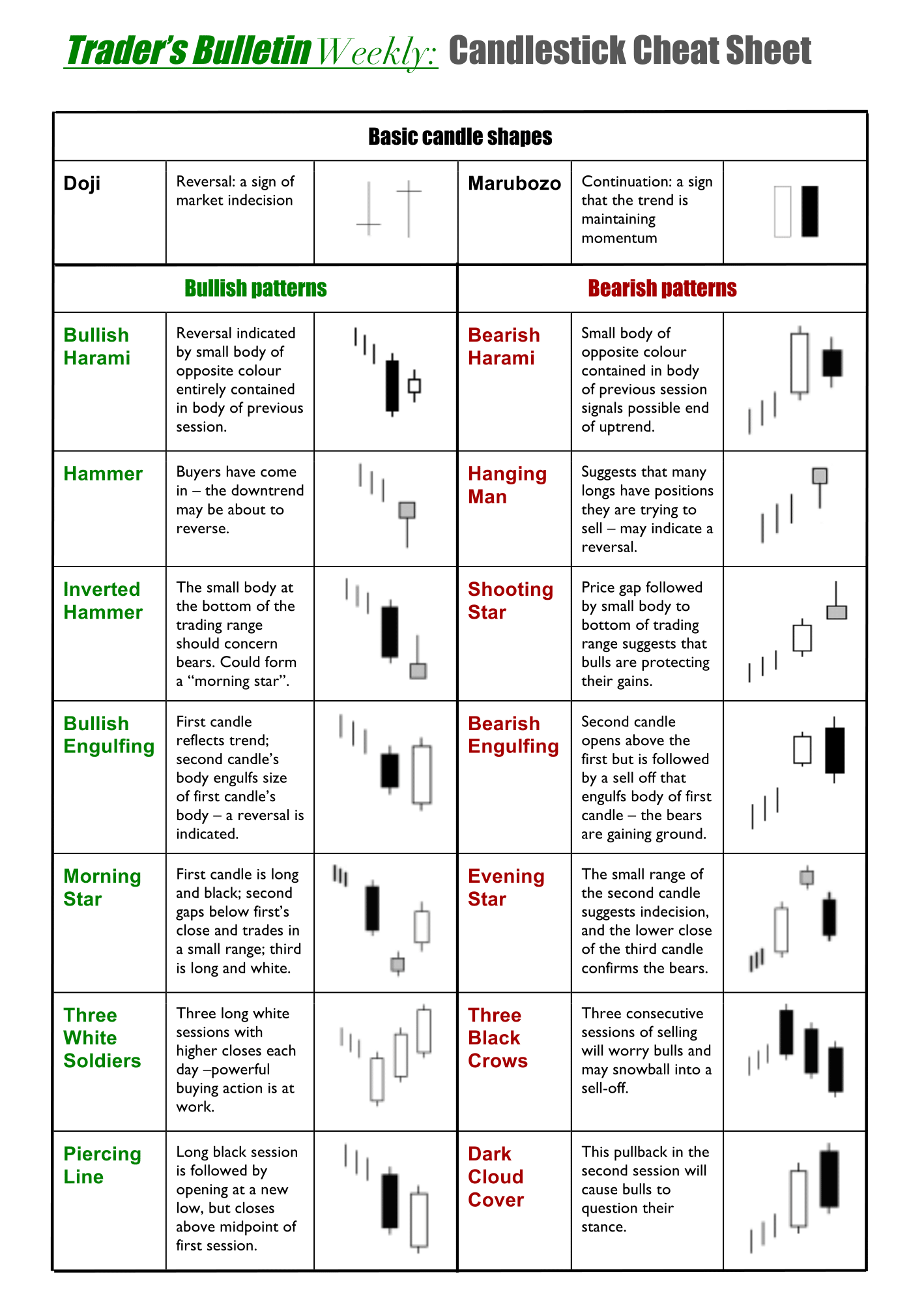

Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. An investor could potentially lose all or more than the initial investment. Individuals must consider all relevant risk factors including their own personal financial situation before trading. Risk Disclosure: The risk of loss trading securities, futures, forex, and options can be substantial and is not for every investor. For more information on Candlestick Patterns, please visit our full candle pattern glossary here. So be sure to understand the importance of what candle patterns are showing, and how they will assist in making the buying/selling decision in your trading. But remember that this would require a little patience to understand the true meaning of this specific candle pattern. Meaning, with bearish confirmation, the Hanging Man is a potential bearish candle signal.

In principle, the hanging man's lower shadow should be two or three times the height of the real body.Īn important part of utilizing the Hanging Man pattern is that the hanging man candle itself is only as strong as the confirming, immediately next candle. It signals the market has become vulnerable, but there should be bearish confirmation the next session with an open, and better is a close, under the hanging man's real body. But when this line appears during an uptrend, it becomes a bearish hanging man. The hanging man and the hammer are both the same type of candlestick pattern (i.e., a small real body, with little or no upper shadow, at the top of the session's range and a very long lower shadow). The pattern that you see here is called a Hanging Man pattern.Ī top candlestick reversal pattern that requires confirmation. While many candle patterns will provide you with the understanding of who is controlling the market (buyers vs sellers), there are other concepts to ensure you recognize.

0 kommentar(er)

0 kommentar(er)